maryland digital advertising tax sourcing

The new law HB. Its modeled after the digital services taxes weve seen adopted in other countries.

Unilever To Acquire Paula S Choice Skincare Unilever

Despite all the above Maryland intends to enforce its digital advertising tax on January 1 2022 if it can.

. 732 imposes a tax of up to 10 on gross revenue from digital advertising services placed by large digital advertisers such as Facebook Inc. The digital advertising gross revenues tax took effect January 1 2022 and the first payments are due April 15 2022. 2 The regulations provide a set of rules for sourcing digital.

While the Maryland Tax is imposed on digital advertising services in the state the Act does not include sourcing rules or methodologies and leaves it to the Comptroller to adopt regulations that determine the state from which revenues from digital advertising services are derived. New Yorks bills A10706 and S08056-A followed the same general structure as Maryland with a 25 - 10 digital advertising gross revenues tax. Two months later lawmakers passed a subsequent bill delaying the taxs implementation until 2022 an.

03120101 - 03120106 Final RegulationsThe DAT is currently scheduled to take effect on January 1 2022 and will apply to persons with annual gross. Plaintiffs in both cases allege the tax. Marylands first-in-the-nation gross revenue tax on digital advertising took effect on March 14.

One in federal court and one in state court. Effective March 14 2021 the Maryland sales and use tax applies to the sale or use of a digital product or a digital code. Effective on January 1 2022 the digital advertising tax is imposed on the annual gross revenues of a person derived from digital advertising services in Maryland.

This new law imposes a tax on annual. First is the lack of clear sourcing rules. The Digital Ad Tax is imposed on a businesss annual gross revenues defined as income or revenue from all sources before any expenses or taxes computed according to generally accepted accounting principles derived from digital advertising services in Maryland.

On November 24 2021 the Office of the Comptroller of Maryland MD Comp adopted final regulations outlining how the states new tax on gross revenues from digital advertising services DAT will operate Md. Review the latest information explaining the. This page contains the information you need to understand file and pay any DAGRT owed.

The second bill HB. New York Digital Advertising Gross Revenues Tax. At that date the sales and use tax rate on a sale of a digital product or a digital code is 6.

However this tax is limited to advertisements that use personal information about the people the ads are being served to. On August 31 2021 the Office of the Comptroller of Maryland Maryland Comptroller issued a proposed regulation proposed Md. Massachusetts is one of several states interested in following Marylands lead.

On December 3 2021 the Maryland Comptroller published notice of its adoption of the digital advertising gross revenues tax regulations which was originally proposed on October 8 2021. The DAT is currently scheduled to take effect on January 1 2022 and. New York A734 S1124 S302 Texas.

Digital advertising revenues sourced to Maryland of 1 million or more. 732 establishes a new digital advertising gross revenue tax the first in any state. The nations first tax on digital advertising gross revenues is facing legal challenges from numerous entities in two lawsuits so far.

For persons with global annual gross revenues of 100 million through 1 billion the tax rate is 25 of the assessable base. The governor vetoed it and the House let it rest until February 2021 when it overrode the veto. The digital advertising tax applies to annual gross revenue derived from digital advertising in Maryland and is imposed at scaled rates between 25 and 10.

The Maryland Comptroller recently issued final regulations interpreting the Maryland digital advertising services tax. The tax is imposed on entities with global annual gross revenues of at least 100 million that have annual gross revenues derived from digital advertising services in Maryland of at least 1 million in a calendar year. Persons with global annual gross revenues equal to or greater than 100000000 must pay a tax on the portion of those revenues derived from digital advertising services in the state of Maryland.

732 on February 12 2021 making Maryland the first state in the country to adopt a tax on. Taxation of digital advertising services. The Maryland gross revenues digital advertising tax became effective for tax years beginning after December 31 2021.

03120102B Proposed Regulation outlining how the states new tax on gross revenues from digital advertising services DAT will operate. Earlier today the Maryland State Senate completed the General Assemblys override of the Governors veto making the Maryland digital advertising tax the first of its kind in the United States. Maryland digital advertising tax sourcing Monday February 28 2022 Edit Its a gross receipts tax that applies to companies with global annual gross revenues of at least 100 million and with digital ad revenue sourced to Maryland of 1 million or more.

Its a gross receipts tax that applies to companies with global annual gross revenues of at. The effective date subsequently was delayed from 2021 until 2022. The bill is pending action by the governor who has 30 days to sign veto or allow the bill to become law without his action.

An apportionment fraction is to be used to determine the annual. And Google Inc in Maryland. For persons with global annual gross revenues of over 1.

Per the Maryland Administrative Procedure Act the final adopted regulations will go into effect in 10 calendar days or December 13 2021See. House Bill 732 adds a new tax imposed in a new Title 75 to the Tax General Article of the Maryland Code. The statutory references contained in this publication are not effective until March 14 2021.

The tax applies to annual gross revenue derived from digital advertising in the state and is imposed at scaled rates between 25 and 10 beginning with taxpayers that have at least 100 million in global annual gross revenue. Digital advertising gross revenue tax. In March 2020 Maryland lawmakers adopted legislation creating a first-in-the-nation tax on digital advertising served into the state.

The rate of tax is determined based on the persons global annual gross revenues. The General Assembly directed the Comptroller to adopt regulations that determine the state from which revenues from digital advertising. 1 This tax which is intended to be imposed on the annual gross receipts derived from certain digital advertising services provided in Maryland became effective on Jan.

The Maryland General Assembly on April 12 2021 passed Senate Bill 787legislation that revises two digital services tax laws enacted earlier this year.

Splashtop Remote Access Remote Support Software

Alexander Boehm Site Manager Talke Usa Inc Linkedin

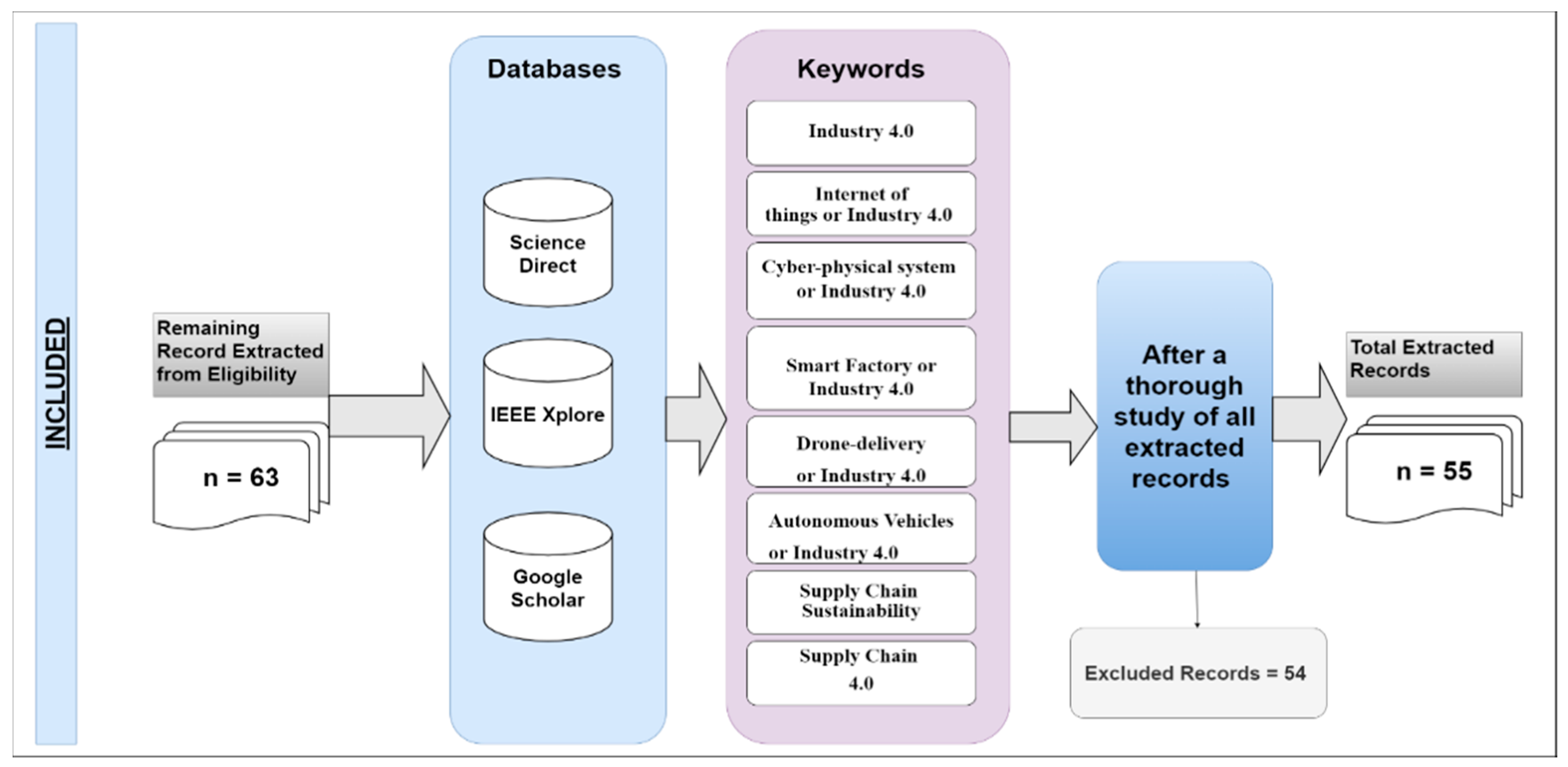

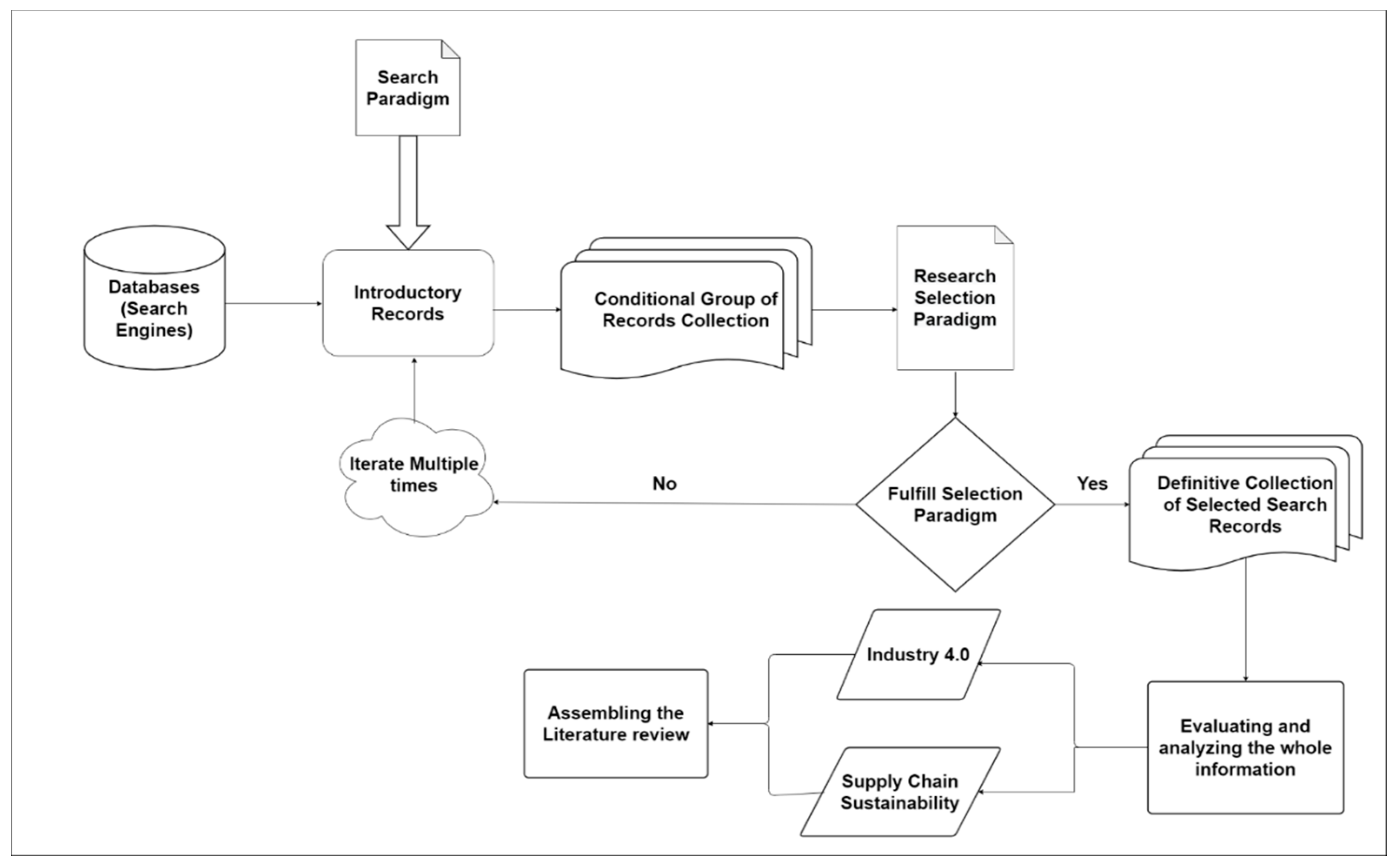

Sustainability Free Full Text Role Of Industry 4 0 In Supply Chains Sustainability A Systematic Literature Review Html

Factor Analysis Using R Analisis Fundamental Pengusaha Bisnis

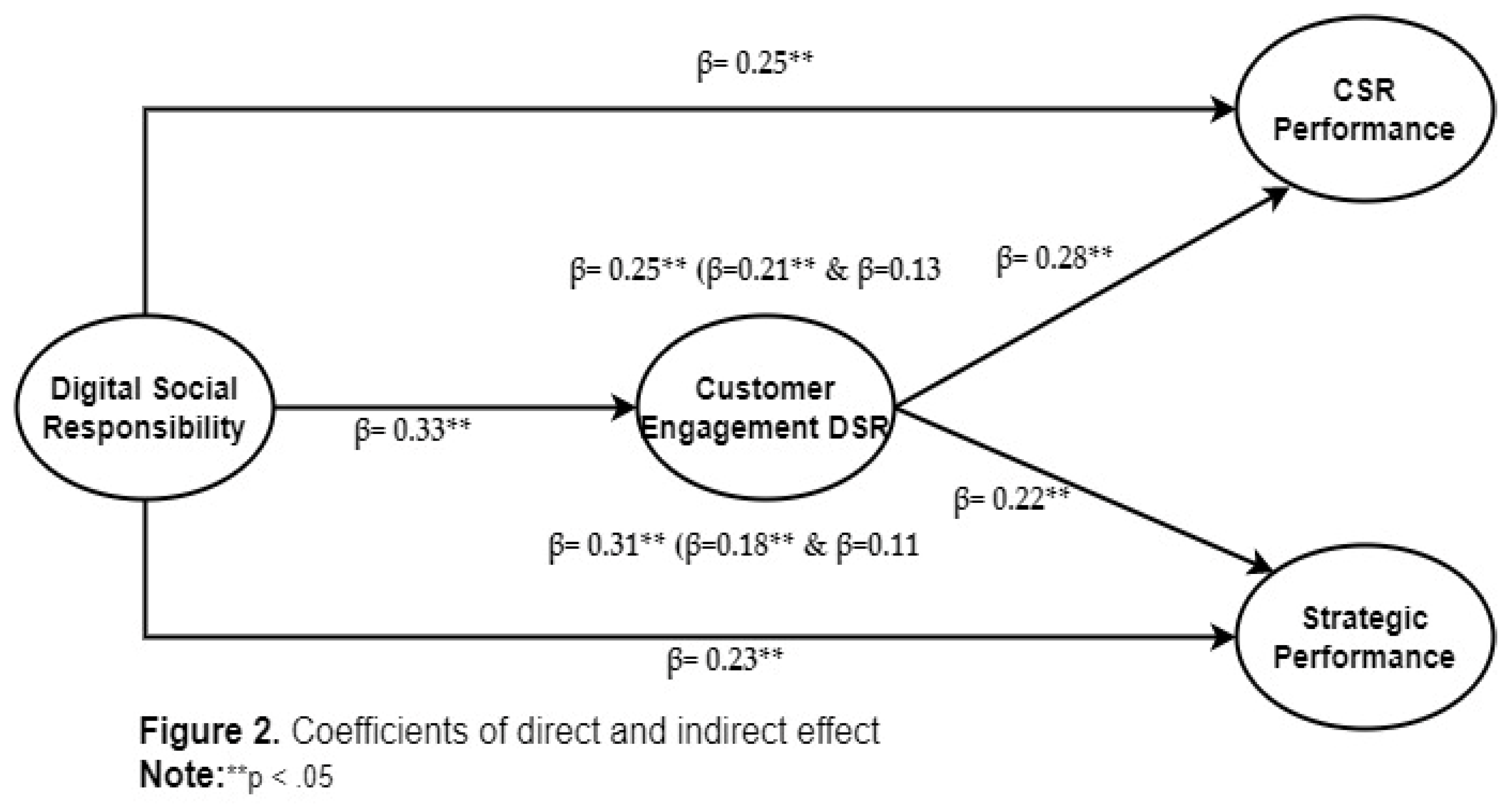

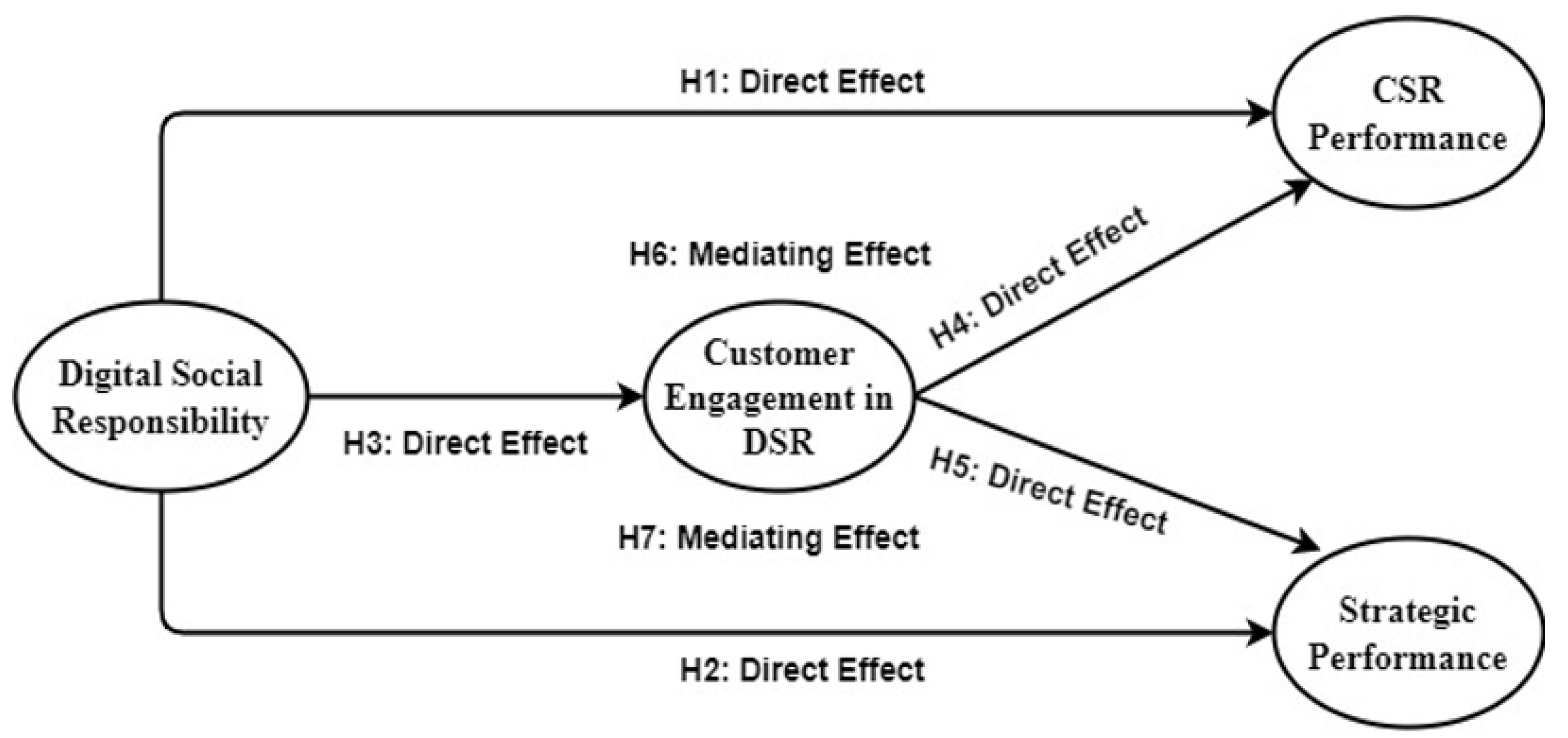

Sustainability Free Full Text Digital Social Responsibility Towards Corporate Social Responsibility And Strategic Performance Of Hi Tech Smes Customer Engagement As A Mediator Html

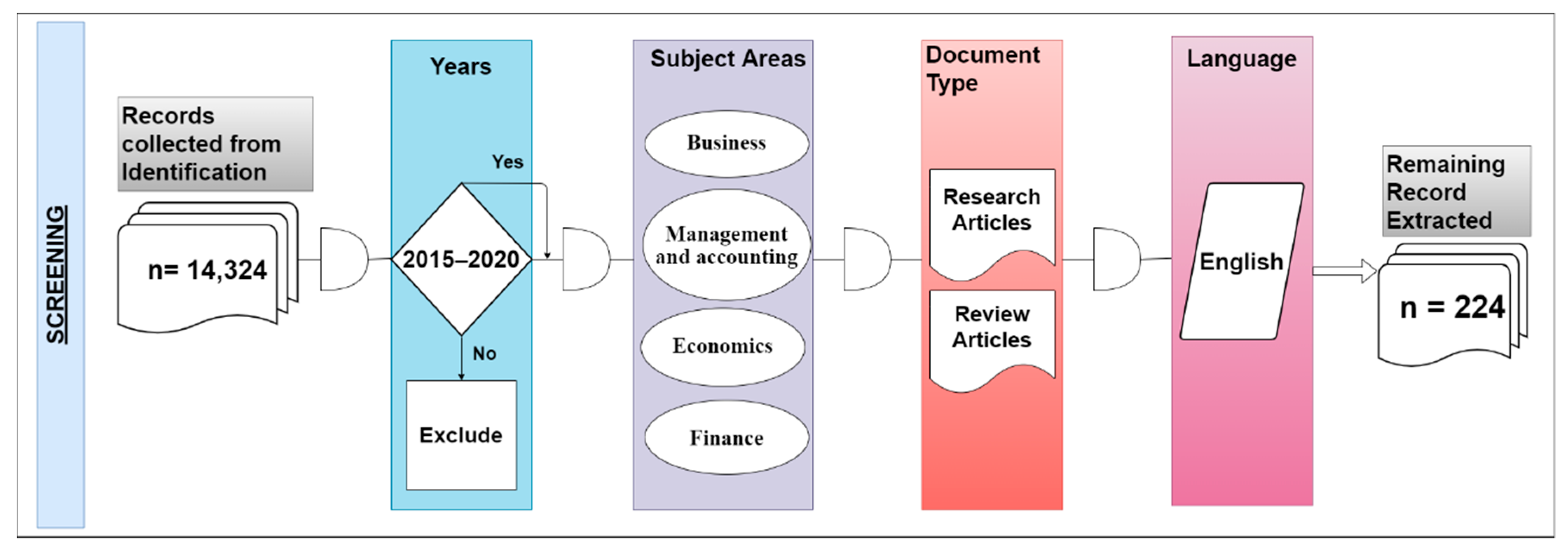

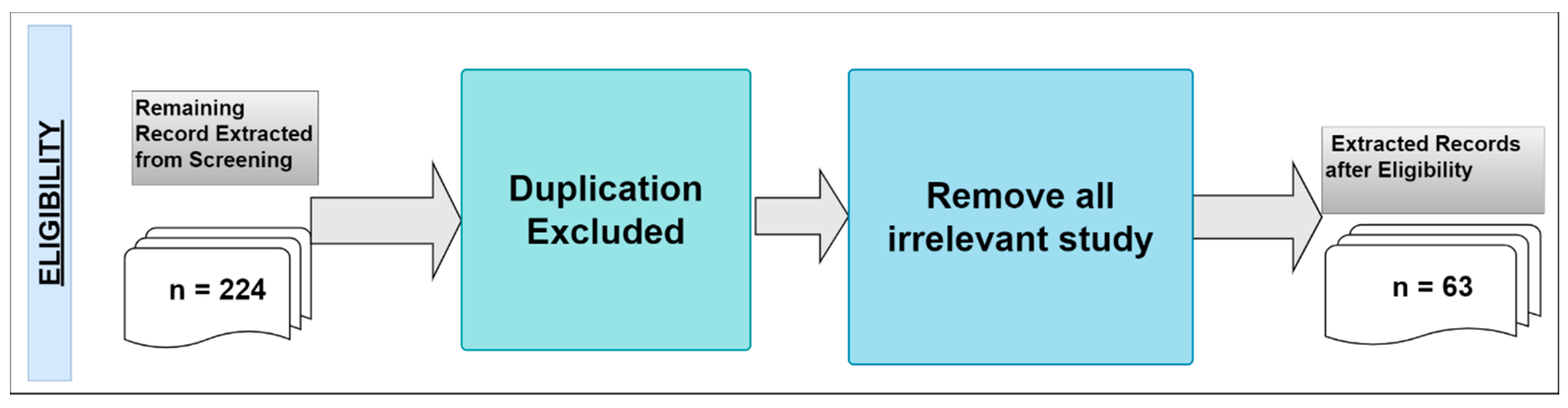

Sustainability Free Full Text Role Of Industry 4 0 In Supply Chains Sustainability A Systematic Literature Review Html

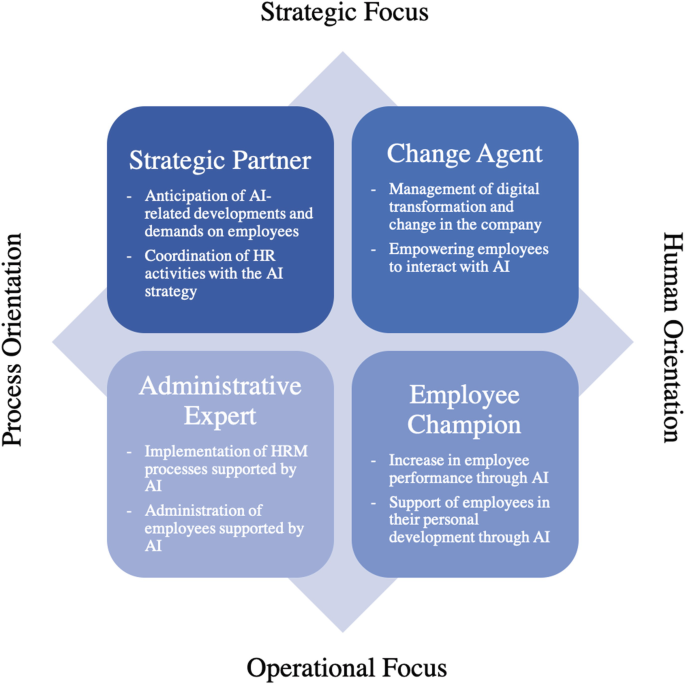

Yes Ai Can The Artificial Intelligence Gold Rush Between Optimistic Hr Software Providers Skeptical Hr Managers And Corporate Ethical Virtues Springerlink

Sustainability Free Full Text Role Of Industry 4 0 In Supply Chains Sustainability A Systematic Literature Review Html

Amy Scott Tax Specialist Shift Digital Linkedin

Smarttop Convertible Top Module For Ferrari 360 And F430 Spider Price Reduction

Banff Sunshine Village Opens For Summer Skiing And Snowboarding

Atlanta Luxury Realtor Debra Johnston Presents Rare Private Townhouse At Waldorf Astoria Hotel

Sustainability Free Full Text Digital Social Responsibility Towards Corporate Social Responsibility And Strategic Performance Of Hi Tech Smes Customer Engagement As A Mediator Html

How To Shift Consumer Behaviors To Be More Sustainable A Literature Review And Guiding Framework Katherine White Rishad Habib David J Hardisty 2019

Sustainability Free Full Text Role Of Industry 4 0 In Supply Chains Sustainability A Systematic Literature Review Html

Telcos Urge Govt To Continue Tech Neutral Approach To 5g Economies Of Scale Reap The Benefits Intervention